Published October 13, 2025

Personal loan vs. line of credit: Which is right for you?

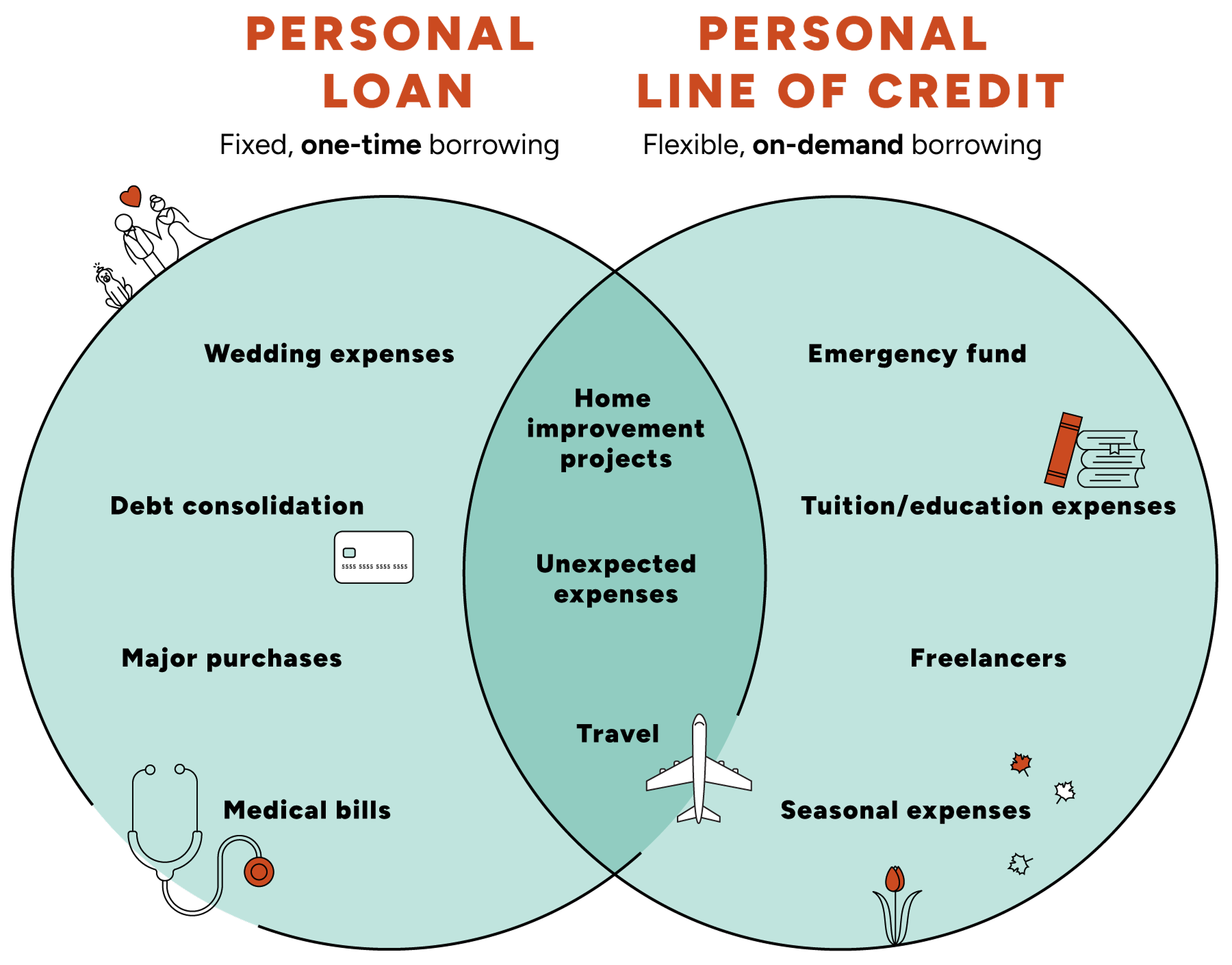

Borrowing money for big purchases is very common. Understanding the difference between a personal loan and a line of credit is the first step to choosing the right option.

Here’s a clear breakdown of how each works, their pros and cons, and scenarios where one might make more sense than the other.

What is a personal loan?

Key features

A personal loan is a lump sum of money you borrow and repay in fixed installments over a set term—like a mortgage or car loan, but more flexible in purpose.

- Loan type: Lump sum

- Interest: Fixed rate

- Repayment: Fixed monthly payments over a set term

- Best for: Large, one-time expenses with a defined cost

Common uses

- Wedding expenses

- Home renovations with a set budget

- Debt consolidation

- Major purchases (car, appliances)

- Medical bills

What is a personal line of credit?

Key features

A personal line of credit offers flexible, on-demand borrowing. You’re approved for a maximum limit and can withdraw funds as needed during a “draw period.” You only pay interest on what you use.

- Loan type: Revolving credit

- Interest: Variable rate

- Repayment: Flexible

- Best for: Ongoing or unpredictable expenses

Common uses

- Emergency fund

- Home improvement projects with evolving costs

- Tuition or ongoing education expenses

- Freelancers smoothing out irregular income

- Seasonal expenses (holidays, back-to-school)

Side-by-side comparison

Which one is right for you?

When to use a personal loan

Choose a personal loan when:

- You know the exact amount you need

- You want predictable monthly payments

- You’re making a large, one-time purchase

- You prefer a fixed interest rate and payoff timeline

When to consider a line of credit

Choose a personal line of credit when:

- Your costs are unpredictable or spread out over time

- You want ongoing access to funds

- You’re managing cash flow or emergencies

- You want to pay interest only on what you use

Pros and cons of each

Dive deeper: Secured vs. unsecured

Now that you know the difference between a personal loan and a personal line of credit, there are a few more factors to consider.

Each borrowing option can be either secured or unsecured. Secured loans require some type of collateral as a condition of borrowing and often have lower rates than unsecured loans.

CBNA Tip: You can use your house as collateral—that’s when we get into home equity, which is an entirely new category of loans and lines of credit.

You may be able to get a better rate with a secured loan based on the equity or assets you’ve built. Talk to a banker to find out what you can qualify for and make the best decision for your situation.

Compare borrowing options

Both personal loans and personal lines of credit can help you reach your financial goals—whether that's funding a big life event or covering unexpected costs. The key is to match the product to your situation and spending style.

Not sure which is right for you? Explore all your loan options or speak with a financial expert who can walk you through the details.

Explore our Financial Literacy Hub and our blog for content that helps you make money decisions confidently.