Loan Options

We all have our project lists, dream vacations and big purchases. But saving up for those larger expenses can take a long time. A loan from Community Bank can help you enjoy your dreams sooner.

- Want to know how much house you can afford? .

- Found your dream home? Apply for your mortgage online.

- Shopping for a new home? Save money upfront with our no closing cost mortgage loan option.

- Envisioning a kitchen remodel? Fund it with a home equity loan or line of credit.

- Planning the trip of a lifetime? Ask us about our rates on personal loans.

- Taking your start-up to the next level? A business loan can make all the difference.

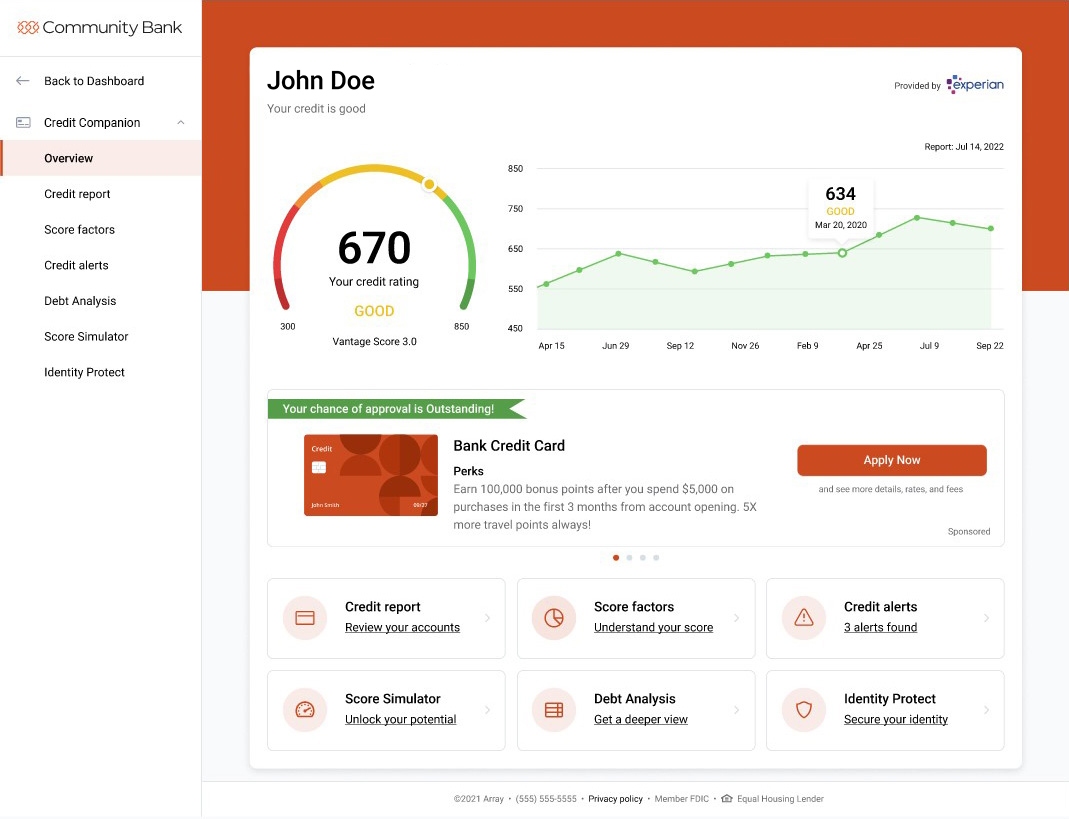

- Access to CBNA Credit Companion℠, a free credit report monitoring tool

No matter what you’re dreaming of, our friendly, knowledgeable loan experts can help find the right loan for you. And they’ll help with low rates, flexible terms, an easy application process and approvals made right at your branch, or conveniently online.

Please enter your zip code, then select a location from the options shown. You will then be taken to the full form. Thank you.

For products in your area,

select your nearest CBNA location.

Explore More

What is a loan-to-value (LTV) ratio? Here’s why it matters.

Feel stuck in your starter home? Here are 10 ways to upgrade your space.

Special Purpose Credit Program: Amun’s Story

Stay on top of your credit score

Your credit score is a key part of your financial wellness, so it’s important you keep an eye on it. We make it easy with CBNA Credit Companion℠. This free service lets you view your credit report and score any time you log in to your account, without affecting your credit score.