Published September 8, 2025

How to build a tiered savings strategy with a money market account

If your savings strategy starts and ends with one account that’s not growing, it’s time for a new strategy that gives you greater flexibility and earnings.

A tiered savings plan with money market accounts can unlock smarter money habits—helping you stash your cash in ways that work for you.

By divvying up your funds across interest-earning accounts, you can create a system that gives you access to what you need now, while growing what you’ll need later.

Let’s break down what a money market account really is, where it fits into a tiered strategy, and how it helps you do more with your money.

What is a money market account?

Money market accounts (MMAs) are federally insured bank deposit accounts. They offer higher interest rates than regular savings accounts and you can access your money immediately without penalty.

Interest rates on MMAs are often “tiered,” so the higher your balance, the greater your interest rate. Most MMAs also offer a limited number of transfers and check, debit card, and autopay withdrawals each month.

Key features of MMAs with Community Bank:

- Higher interest rates than traditional savings

- Up to three free withdrawals (checks, ACH, POS) per month

- Unlimited transfers made in-branch

- FDIC-insured

- Minimum balance requirements

- Free online and mobile banking

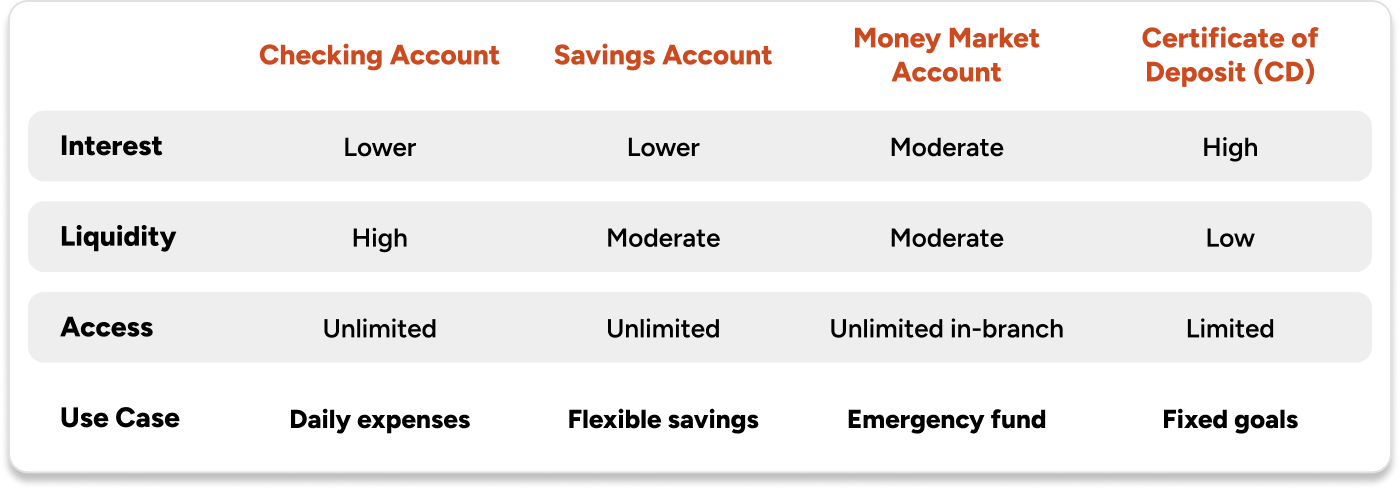

How MMAs compare to savings and checking accounts

MMAs are a low-risk way to grow your savings while still giving you access to your money. You’ll earn more interest than in a savings or checking account without having to lock up your cash.

If you have a cash surplus and won’t need to use the money right away, certificates of deposit (CDs) offer even higher interest rates than MMAs. However, CDs have low liquidity—meaning your money is locked in for the duration of the term and not easily accessible.

Still confused about the difference between MMAs and CDs? This blog dives in deeper to show how each account works.

The case for tiered savings strategies

Once you understand how each account works, you can start using them together to make the most of your funds. This is called a “tiered savings strategy.”

Why tiered savings boosts flexibility and returns

Think of this approach like a financial tackle box: Each type of account is a compartment (or “tier”) that serves a specific purpose. You decide where to put your money based on when you’ll need to use it—and how much you want it to earn in the meantime.

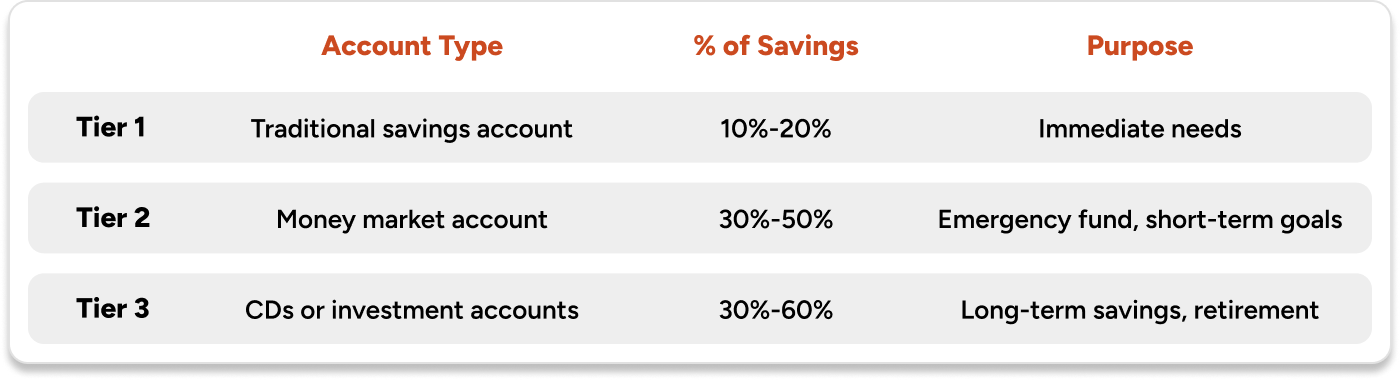

- Tier 1: Immediate needs (low yield, high access)

- Tier 2: Short- to mid-term savings goals (higher yield, moderate access)

- Tier 3: Long-term savings (highest yield, least access)

Putting all your money in Tier 1 would leave interest on the table—but putting it all in Tier 3 means you can’t access it when you need it. That’s where a tiered savings strategy comes in.

Divvying up your savings among tiers helps you find the sweet spot between liquidity (how much you can access) and earnings. It accounts for unplanned expenses while still making the most of the money you’ve saved.

Where money market accounts fit in a tiered plan

This approach only works if you allocate your savings accordingly, then actually use the accounts for their intended purpose.

Tier 1: Everyday Funds

When checking isn’t enough, you can dip into a traditional savings account that has no withdrawal fees. You might tap into your Tier 1 account for immediate needs like:

- Monthly bills

- Groceries

- Car repairs

Tier 2: Flexible Savings with MMAs

Tier 2 is your buffer between “spendable” and “untouchable.” This mindset encourages discipline: You can use these savings, but they’re not as tempting as Tier 1.

This is where MMAs come in. While they earn more than a savings account, you can still access funds if you really need them—making MMAs ideal for:

- Emergency funds (3-6 months of expenses)

- Saving for taxes

- Planning for big purchases (like a vacation or a car down payment)

Tier 3: Long-Term Growth

This tier should be a higher-interest account, like a CD or even an IRA, that grows your savings over time. It’s for funds you won’t touch for a while, toward big goals like:

- A home down payment

- Future tuition costs

- Retirement savings

Sample allocation plan using MMAs

Tips to maximize your tiered savings strategy

1. Automate transfers

Set and forget. Automate monthly deposits to your MMA so saving becomes second nature.

2. Monitor account balances

Many MMAs offer better rates for higher balances. Know when to level up!

3. Do your research

Not all MMAs are created equal. Look for ones that offer competitive interest with flexible access (like ours).

4. Re-evaluate quarterly

Life changes, so your savings plan should, too. Reallocate as goals shift.

Fine-tune your financial plans

Most people think saving is just about putting money away, but where you put it matters just as much. A tiered plan anchored by a money market account gives you both financial control and peace of mind.

To customize an approach that works for your needs, contact an expert today.

Explore our Financial Literacy Hub and our blog for content that helps you make money decisions confidently.