Choose the right card for you.

Apply for your card today.

What do you want from a credit card? Whether it’s generous rewards, straightforward credit, or improved credit—we’ve got it. Check out what each card offers and choose the right one for the way you use credit.

Credit Card Options

Maximum Rewards® Visa Signature® Card

Unlimited Rewards.

Every purchase. Every day.

- Unlimited 1.5% Cash Back1

Every purchase, no categories to keep track of. - Save on Interest

Receive an ultra-low introductory APR on purchases and balance transfers. - Choose Your Rewards

Redeem rewards your way—cash back, gift cards, travel, or merchandise.1

Must apply here for this offer.

Offers vary elsewhere.*

Platinum Edition® Visa® Card

Straightforward credit.

Available when you need it.

- Save on Interest

Receive an ultra-low introductory APR on purchases. - Consolidate Higher-Interest Balances

Receive an ultra-low introductory APR on balance transfers.

Must apply here for this offer.

Offers vary elsewhere.*

Secured Visa® Card

Establish or Improve Your Credit.

- Request your own credit limit by providing a single deposit between $300 and $5,000 (multiples of $50) when you apply, subject to credit approval.

- Help Build Your Credit

Get automatic reporting to the 3 major credit bureaus to build a positive credit history. - Take Control of Your Credit

Take advantage of free tools that keep you on track, like AutoPay, so you never forget a payment.

Must apply here for this offer.

Offers vary elsewhere.*

Want more from your card?

All personal cards offer:

Contactless Technology

Secure, simple, and touch-free payments.

Online Services

Manage your account online to check credit card balances, view transactions, make payments, and more.

Mobile Account Access

Manage your account safely and securely, from anywhere, with the mobile app.

Fraud Protection

We monitor your account and alert you of any suspicious activity.

Online account access for your credit card provides you the quickest and easiest way to:

- Activate your credit card

- Make payments

- Transfer balances

- Request Credit Limit Increases

- View statements

- And much more

Simply access your account by clicking the link below:

Checking Products

Get a free gift

Enjoy plenty of free with Carefree Checking℠ including a free gift when you open an account online or in-branch.

Mortgages

Save on your new home from day one

With a no closing cost mortgage, the savings can add up to thousands of dollars in upfront expenses.

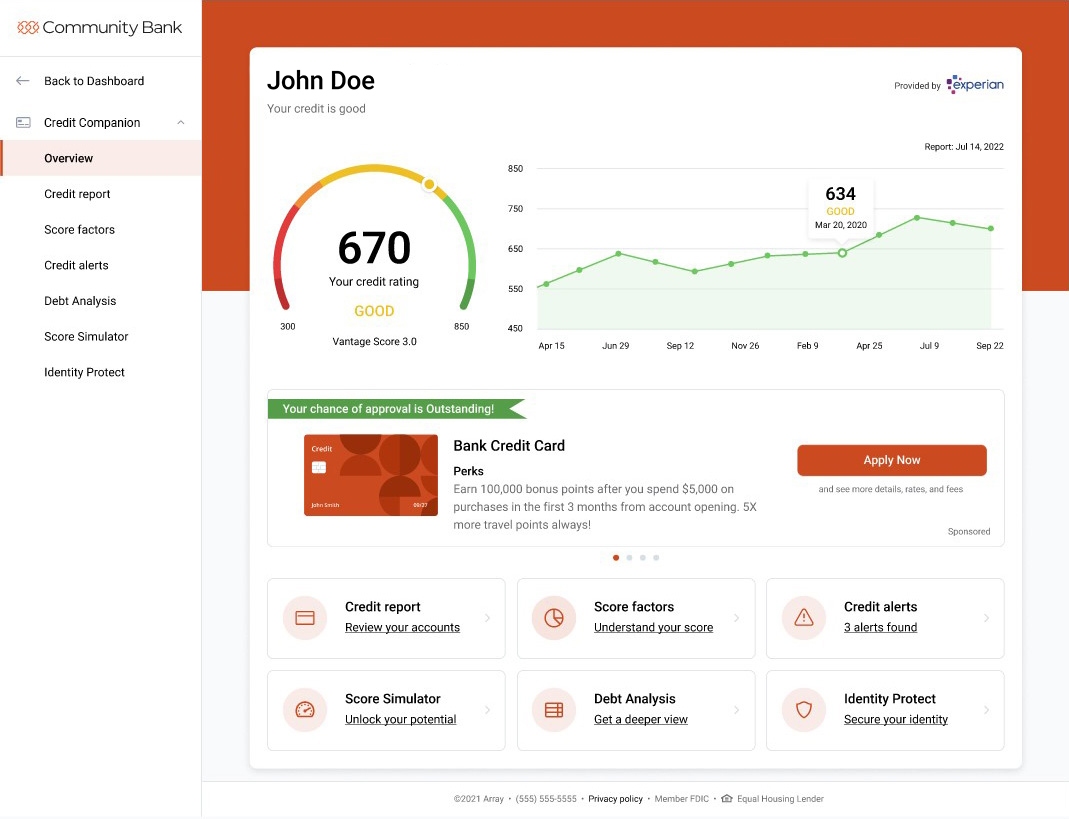

CBNA Credit Companion℠

Stay on top of your credit score

This free service lets you view your credit report and score any time you log in to your account, without affecting your credit score.