Published February 24, 2025

What is CD laddering? A beginner’s guide to a smart savings strategy

If you’re just starting out with saving, you may have heard of CDs (certificates of deposit).

CDs are investments that give you a fixed interest rate for a set period of time, called the "term." While they typically offer higher rates than savings or money market accounts, you have to leave your investment in the account for the full term to avoid a penalty. When the term ends, the CD "matures," and your money becomes available to you.

Putting all your money into one CD might feel like too much of a commitment, especially one with longer terms. That’s where CD laddering comes in handy.

What is CD laddering?

Laddering is a great strategy for anyone looking to save with CDs. It’s an approach that lets you spread your money across several accounts that mature at different times, instead of putting it all in one CD.

This way, you’re always investing—even if one CD expires. Laddering lets you choose whether to reinvest the money from a matured CD into a new one or withdraw matured funds to use however you like.

With this rotating strategy, you can access some of your money at set intervals without any penalties. Meanwhile, the rest of your savings benefit from higher-rate interest and longer-term stability than other types of saving strategies.

How it works

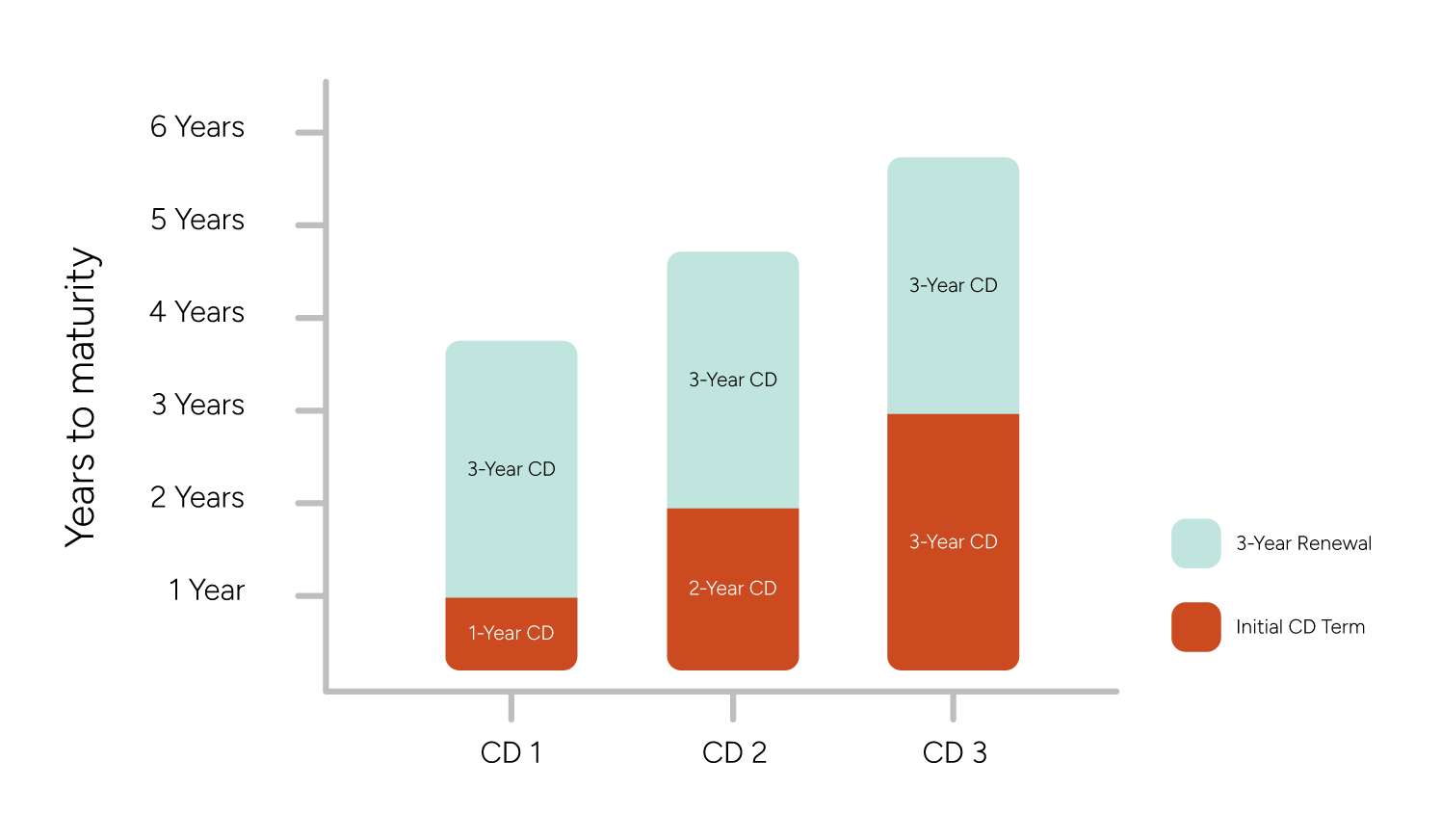

Let’s say you have $3,000 that you want to invest. CDs usually have set terms, like one year, two years or three years. Instead of putting all your money into one three-year CD, you could spread it out across three CDs with different maturity dates, investing $1,000 in each.

One will mature in one year, another in two years, and the last one in three years. Your starting setup looks like this:

- $1,000 in a 1-year CD

- $1,000 in a 2-year CD

- $1,000 in a 3-year CD

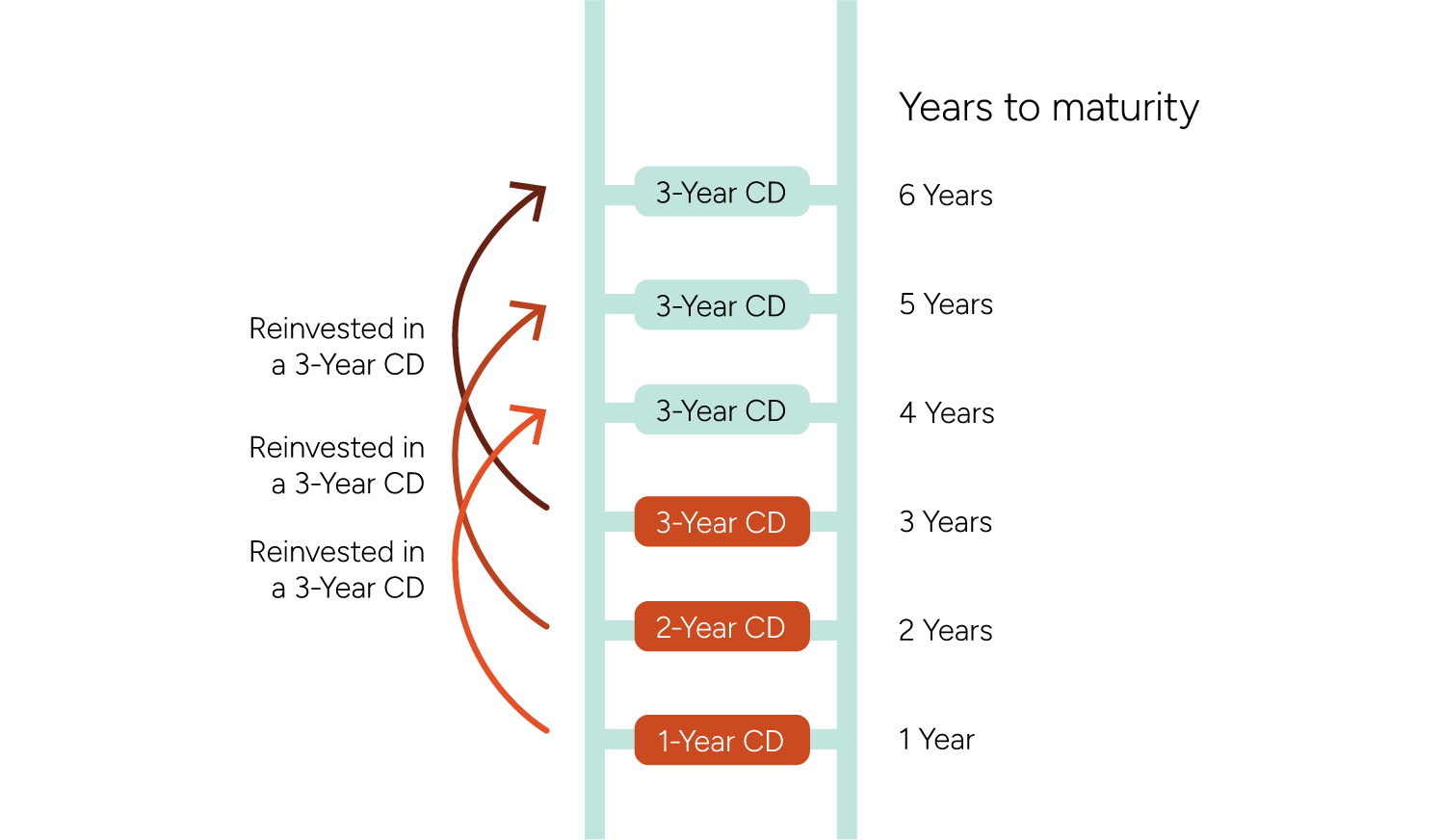

When a CD matures, you can renew it as a new three-year CD. After three years, you'll have three CDs, each maturing one year apart.

This is how your ladder would look if you renewed each CD at maturity:

This strategy allows you to take advantage of higher interest rates from longer-term CDs while keeping access to some of your money each year. You’d also have access to part of the total investment each year without penalty, since one CD will mature annually.

Benefits of CD laddering

- Less risk: It’s a reliable way to diversify investments, and it’s generally less volatile than stocks.

- Better average rate: Make the most of today’s interest rates and reinvest if they rise in the future.

- Maximized long-term earnings: Longer-term CDs often offer better interest rates, increasing your overall earnings.

- Predictable cash flow: Fixed terms let you plan ahead to access funds.

- Hedge against inflation: As your money earns interest, it can keep up with the pace of inflation.

- Consistent access to funds: Since part of your investment is always near maturity, you can access some of your money, if needed.

- Flexibility: You can customize your terms for each of your CDs.

- Safety: Most CDs are FDIC-insured and offer a fixed rate.

How to start a CD ladder

- Choose how much money you want to invest.

- Decide how many CDs you want and the length of time you want to commit to each.

- Calculate your ladder by dividing your investment across different term lengths.

- Adjust your ladder to fit your goals.

Note: The CDs don’t have to hold the same amount of money, so you may opt to open each one with varying balances to accumulate a higher yield. For example, you might want to invest more in shorter-term CDs while their rates are high. - When your first CD matures, you can reinvest the money into a new CD, withdraw it, or transfer it.

Is it right for you?

If you’re looking for a saving strategy that holds up to rate fluctuations over a short period of time, CD laddering might be a good fit. The fixed rates of CDs can give you that stability, while a ladder approach can give you the predictable access to cash that you may need if life throws you a curveball.

CD laddering can be a smart strategy for many savers, but it’s not one-size-fits-all. While the rates you lock in are fixed, market rates can fluctuate, which may influence your strategy. To understand whether a short-term model is better for your situation, consult with one of our local experts to customize a strategy that works best for your savings goals.

Ready to get started saving now?

Open your CD online today.

Explore our Financial Literacy Hub and our blog for content that helps you make money decisions confidently.