Published November 11, 2024

Retirement Saving 101: IRAs

Roth IRAs, traditional IRAs, and index funds are all valuable tools for building wealth. To make the most of them, let’s talk about what they are and how they’re used together.

What is an IRA?

An IRA (individual retirement arrangement) is a tax-advantaged savings account that the IRS created to give investors an easy way to save for retirement.

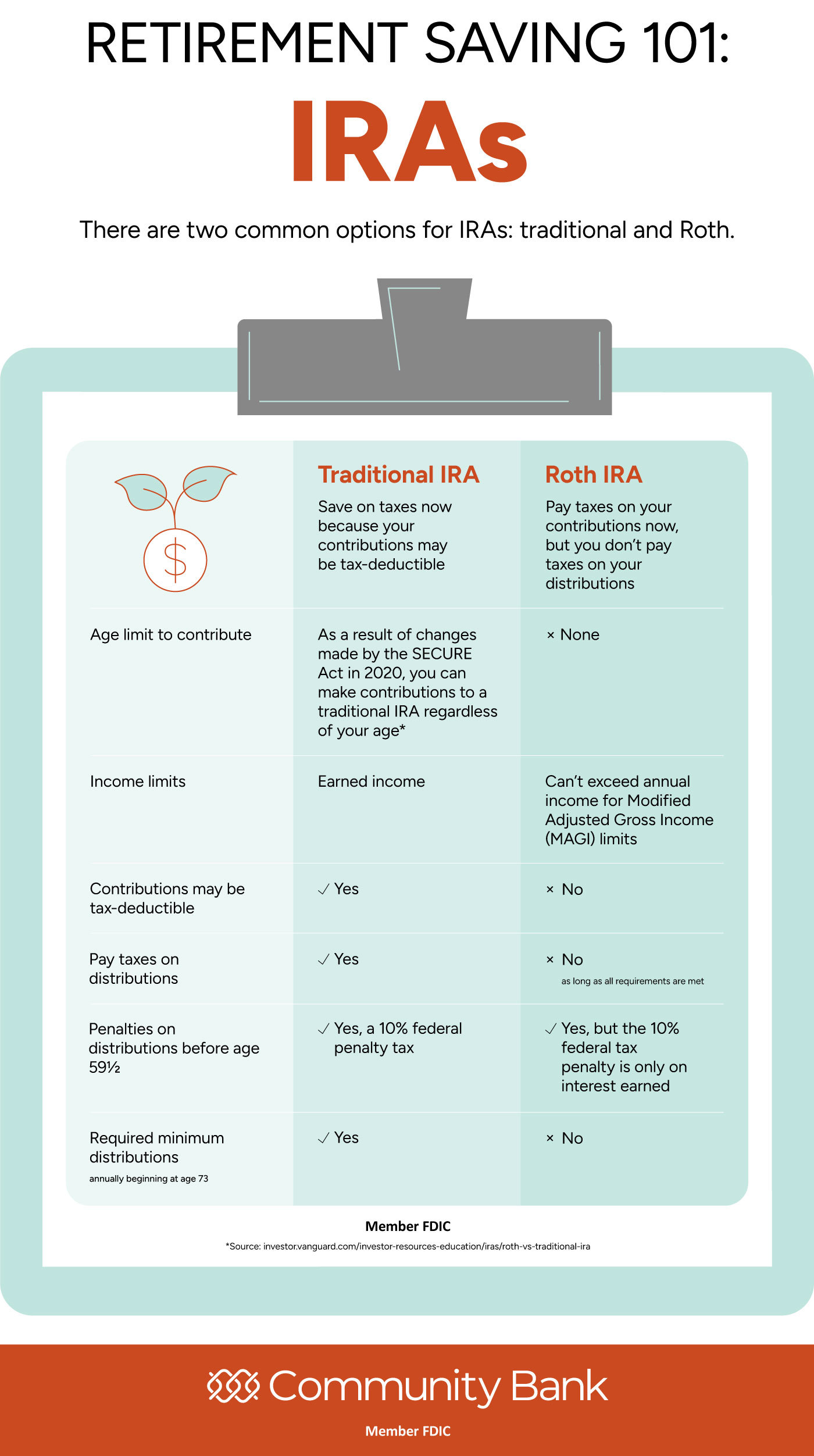

There are two common options for IRAs: traditional and Roth.

A Roth IRA allows you to make after-tax contributions. It’s best suited for people who expect to be in a higher tax bracket when they start taking withdrawals.

- With a Roth IRA, your earnings and withdrawals grow tax-free.

- That is, when you withdraw your money, you may not have to pay taxes! Plus, after you’ve owned the account for five years, you can request a distribution of your money anytime after age 59½.

A traditional IRA may allow you to make pre-tax contributions. It’s best suited for people who expect to be in the same or lower tax bracket when they start taking withdrawals.

- With a traditional IRA, you may get double tax benefits.

- You’re often able to deduct your contributions from your taxable income and the interest grows tax-deferred. That means you don’t have to pay taxes on your investment earnings until you request a distribution—and at that time, you may be in a lower tax bracket.

It’s important to understand where your finances are headed so you can make the best decision to manage them now. Calculate your future finances with this retirement planning calculator.

Whether you’re thinking of opening an IRA or wondering how to get started funding it, our experienced professionals at Community Bank can help steer you toward success. Book an appointment with us to get started.

Explore our Financial Literacy Hub and our blog for content that helps you make money decisions confidently.