Published November 6, 2020

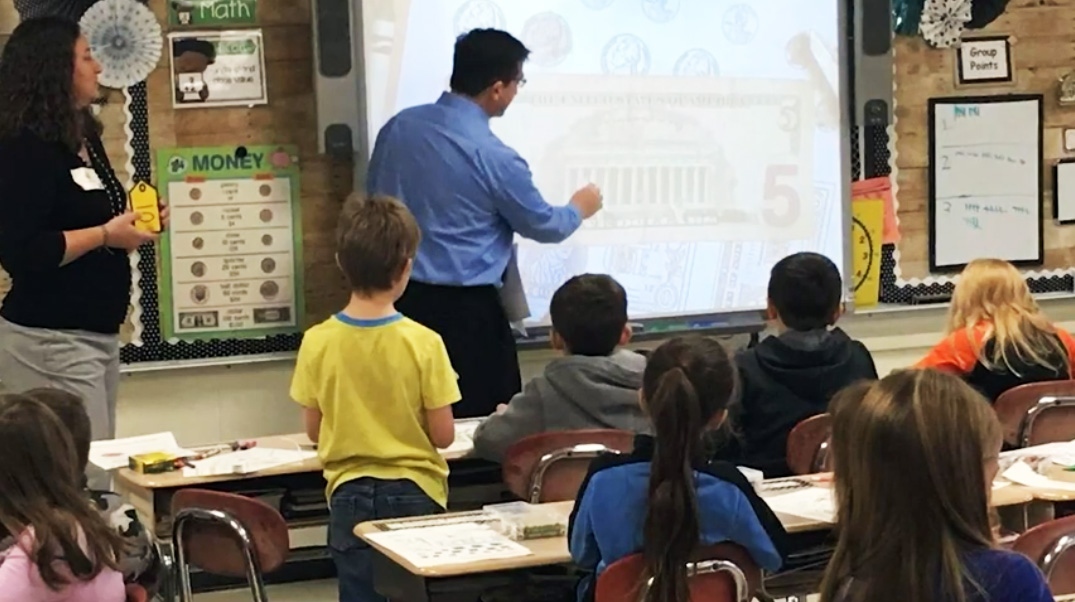

Banking Services: Grades 7-8

Instructor's Guides

Most kids know that banks and other financial institutions (credit unions, savings and loan associations) offer a variety of services. In this lesson, middle school-aged kids will learn about the different types of financial service products available, like checking and savings accounts, and the features of each.

When selecting a checking account, remind your kids to consider the required balance, monthly fees, interest earned, cost of printing checks, and charges for other fees and services. Kids can make wise choices about their banking services once they understand such fundamentals as selecting and managing a bank account, using debit cards and safeguarding personal information against identity theft.

Lesson goals

- Understand the services offered by banks, savings and loans, and credit unions

- List some of the factors to consider when shopping for bank services

- Understand the responsibilities of having a checking account

- Write checks and keep a running balance in a checkbook

- Understand how to deposit a check

- Read and interpret a checking account statement

- Reconcile a checking account using a checking account statement and a check register

- Understand what an ATM card is and explain how it is used

- Understand what a debit card is and explain how it is used

Activities

Download the Practical Money Skills activity workbook and work through the on-screen information and activities with your child. If you use any of the banking services covered in the workbook, help your child understand how you select the services that are right for you.

Explore our Financial Literacy Hub and our blog for content that helps you make money decisions confidently.